Upgrading Strategies For Hospitals

(Golden Jubilee Hospital)

|

|

|

|

|

|

Contents |

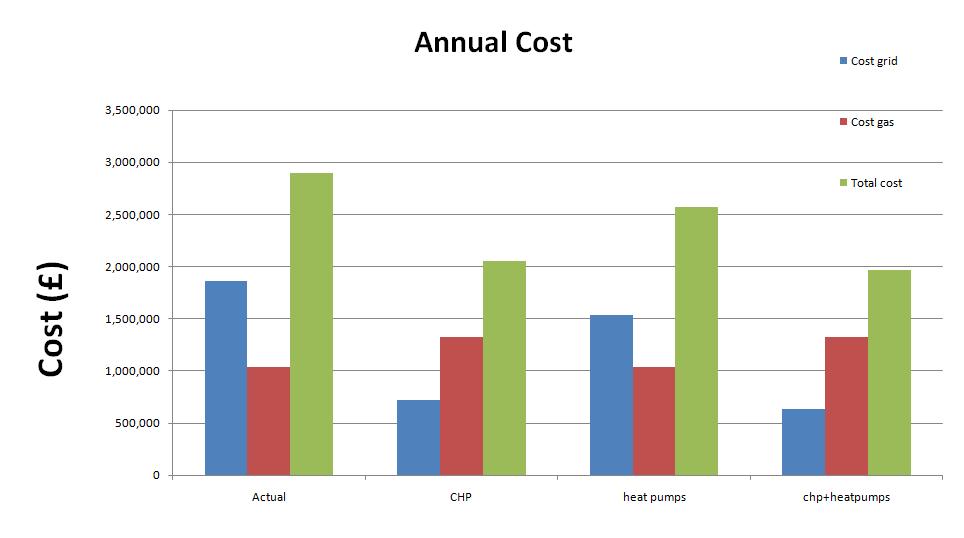

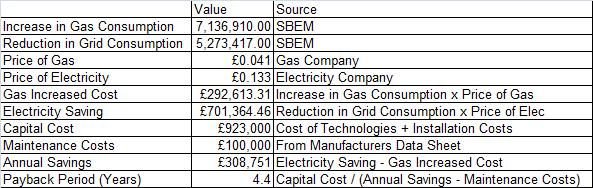

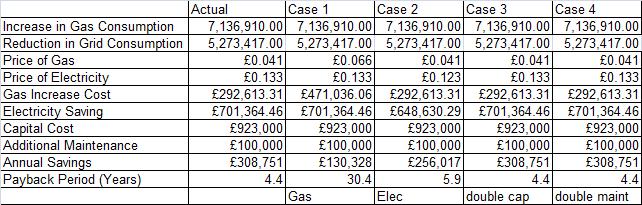

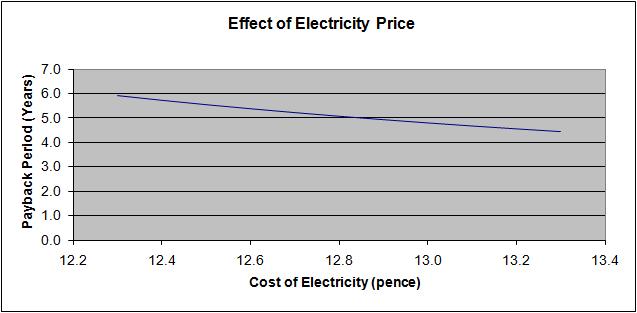

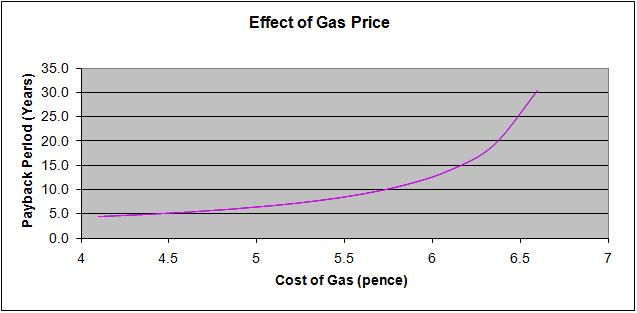

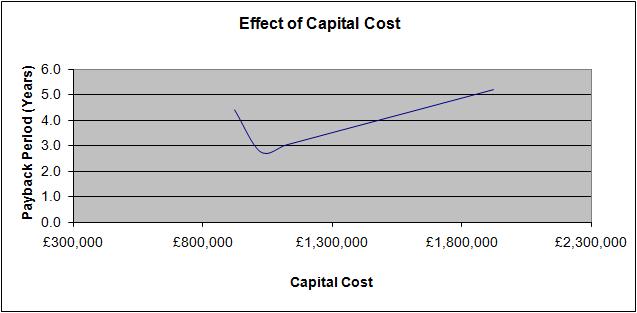

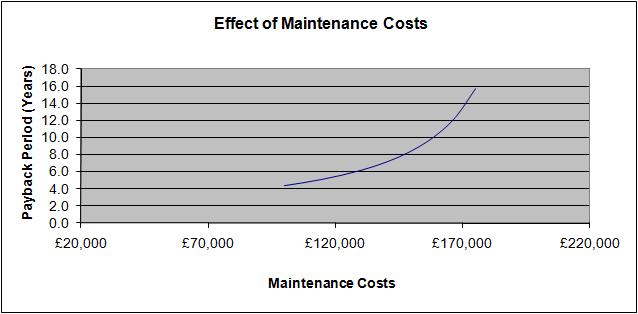

Financial AnalysisFrom our modelling results we were able to undertake a financial analysis of implementing the potential upgrades. This was done by initally considering the running costs for the system at present against each of the alternatives. Once this was completed a cost benifit analysis was carried out where we considered the inital capital costs along with the increased maintenance costs that could be associated. This allowed for a repayment term to be calculated.  The financial results from our models show that implementing CHP & Heat Pumps would make the biggest improvement in the annual energy costs for the hospital. This however is only marginally better than the results of installing only the CHP system, which would have a reduced initial capital investment & maintenance costs. Cost AnalysisWe have found from the modelling results that with the new technologies in place there is a reduction in Carbon Emissions. Whilst this is an achievement in any project we must make sure that it is financially feasible. Therefore we must investigate whether the savings made from these technologies will be able to pay the initial capital costs of installation and the maintenance required on the technologies each year.  Table 1 - Cost Analysis Sensitivity StudyAs the figures in the above table are based on results from modelling and so are susceptible to faults in the calculation it was decided to conduct a sensitivity study to investigate which of the factors would have the greatest effect on the payback period of this project.  Table 2 - Sensitivity Study The above table shows the actual costs and the factors affecting them and then Cases 1-4. In Case 1 the price of gas was raised by 2.5 pence, this made a dramatic difference and lengthened the payback period to over 30 years. In Case 2 the price of electricity is reduced by 1 pence and whilst this did increase the payback period it was only by 2.5 years. In Case 3 & 4 the Capital Cost and Maintenance Costs were doubled respectively. Whilst these had an effect it was nowhere near as much as in Case 1 where the gas price was raised. Below can be seen some graphs which document the increase in Payback Period when the 4 different factors are varied from the initial results. Again what can be seen is that the Gas Price seems to have the most significant effect.     From these results an investigation into other fuel types for the CHP system was initiated as it was evident that a substantial rise in gas price would be damaging to the cost effectiveness of the project. The cost benifit analysis suggests that a repayment period of around 4 and a half years is achievable. Often NHS boards aim for repayment periods of around 3 years however recently they have been increasing the allowable time period for repayment on NHS investments. With regards to installing CHP systems often any repayment period of less than 8 years is considered a sucess. With these two considerations in mind it is suggested that this is a suitable method of upgrading hospitals as the repayment period is within usual targets. |

Renewable Energy Systems & The EnvironmentGroup ProjectIt is the hope of the Energy Systems and Environment project team that the information contained in this website will contribute to the relevant field. Please feel free to use any of the findings presented to further your own study, making due acknowledgement where appropriate. |

|